Advertising

State-of-Play

Report 2022 Where the advertising industry is headed in the cookieless world and beyond Asia Pacific Edition

What you’ll find in this report

The Asia Pacific (APAC) media industry is currently undergoing its most pivotal transformation yet, with recurring themes such as the cookieless world consumer privacy, and programmatic shaping how advertising plays out in our accelerating digital future.

This report explores:

- where the future of digital advertising is headed in 2022

- what challenges and opportunities lie ahead for advertisers and publishers

- where advertisers in the region are planning media investments

- what skill gaps need to be filled and more

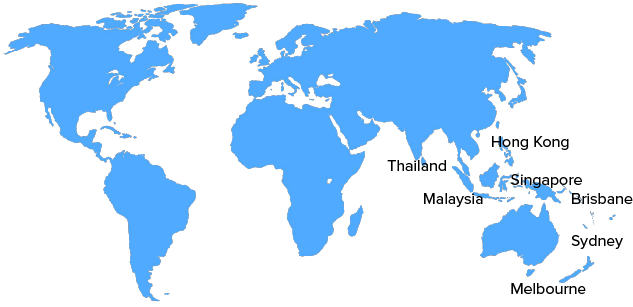

Data collection

Data in this report is from an online survey of first-party respondents conducted from 10-27 August, 2021. The survey generated responses from almost 600 marketing and advertising professionals in each of the following markets: Australia, New Zealand, Singapore, China, Hong Kong, India, Indonesia, Malaysia, and Vietnam. Survey results were collected via SurveyMonkey, and data percentages may not total 100 due to rounding.

Where is advertising headed in 2022 and beyond in Asia Pacific?

As technology continues to accelerate consumer buying behaviour into the digital realm, the advertising industry has been thrown into a quiet frenzy. A few key themes are defining what the future of advertising looks like:

- Marketers, Media Agencies, and Publishers are key partners in the media world and must work to navigate issues such as the impending demise of third-party cookies and evolving global regulation around consumer privacy.

- Businesses are racing each other to be at the forefront of increasingly sophisticated ad tech and martech, along with acquiring the required expertise to participate on more channels and with more formats than ever.

- First-party data, no longer just a bridge to cross in the far-off future, has become central to the conversation of content quality and relevancy, both of which are keys for any business to succeed in the digital environment that consumers (including us) have helped to shape.

- Consent goes hand-in-hand with decisions around investments into the relationships businesses form, whether with a technology partner or with their consumer audiences.

The Quantcast APAC Advertising Industry Survey 2021

Methodology

The facts and figures in this report were determined through a survey of almost 600 participants from the advertising and marketing profession, including executive members and decision-makers–from Agencies (creative, marketing, media alike), Brands, and Publishers of all sizes, located in Australia, New Zealand, and South-East Asia.

Participants were asked to answer a series of questions to help Quantcast better understand their challenges and opportunities in their business and with programmatic advertising, media investments, content preferences, areas to upskill, as well as their opinions and considerations on working with leading ad tech brands.

Because not every respondent has answered all the questions, this report breaks down the respondents’ answers against the number of responses submitted for each category–i.e., if there were 50 respondents to one particular question, these 50 form the 100%.

Where multiple responses result in multiple conclusions, an average was taken to determine the final number used.

Sample questions

- Has the shift in ad spend to larger companies–i.e., the walled gardens (Google, Facebook, Amazon, etc.)–impacted the quality and/or quantity of content you produce?

- What are your top business challenges and priorities that you foresee in the next 12 months?

- Over the next 12 months, how do you anticipate you will invest your/your clients’ advertising dollars in the following channels?

- Which skills or areas would you like to learn about across the next 12 months?

- What are your top obstacles/challenges when it comes to programmatic advertising?

Respondent Breakdown

The final dataset used for analysis (excluding incomplete or irrelevant responses) are counted below:

ANZ

Brands: 19%

Media Agencies: 59%

Publishers: 22%

ASIA

Brands: 20%

Media Agencies: 39%

Publishers: 41%

Australia & New Zealand

Key takeaways from ANZ

- Marketers, media agencies, and publishers see measurement, skills shortages, and marketing in a cookieless world as key challenges, while acquiring first-party data, increasing brand building activity, and enhancing skill sets are seen as top opportunity areas heading into 2022.

- Audience insights and changing consumer behaviour, as well as AI and machine learning technologies are key areas for advertisers to upskill in across 2022.

- Media budgets are on the rise, with significant investment growth in digital channels such as programmatic video and connected TV (CTV).

- As the future of advertising moves toward integrated partnerships, advertisers are looking for ad tech providers that can deliver on campaign performance and help them access deeper audience insights to truly understand their customers.

- When it comes to programmatic, advertisers are primarily facing challenges with data quality and getting the right expertise on board to execute their strategies.

Challenges and Opportunities

Challenges for the year ahead

Attribution is key in the cookieless world, but there is a lack of know-how

Opportunities for the year ahead

Opportunity lies in going back to the basics and relearning data

Staying ahead in an evolving landscape: areas to upskill in 2022

With consumer shifts over the past 2 years, all audience groups are keen to stay close to their changing customers, with marketers and media agencies looking to invest in audience insights over the next 12 months.

Backgrounds in digital marketing, particularly programmatic skills, are lacking and are therefore an area of focus for advertisers.

With investment increasing in the digital marketing space, marketers and media agencies need to ensure they have the teams and partners in place that have the expertise in these fields.

Given the demise of third-party cookies, advertisers will be looking for partners and solutions that can help them navigate and thrive in this new environment.

What areas would you like to learn more about, or upskill in the next 12 months?

Media Investments in the Year Ahead ANZ

Media budgets are growing to meet a highly digitised market

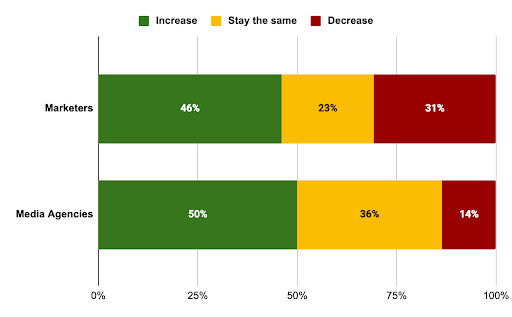

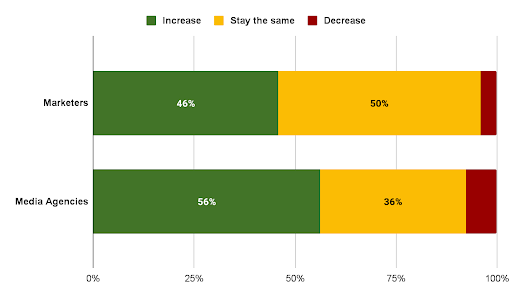

With increased demand for online retail and services, and the revival of industries impacted by COVID-19–such as travel and hospitality–media investment is set to grow across the region, with over 56% of agencies and 45% of brands planning to increase their advertising budgets in 2022.

With digital investment on the up, now is a great time for media agencies and ad tech vendors to showcase their expertise and know-how to help their clients navigate the complexities of the evolving digital advertising ecosystem.

In 2022, do you believe your/your clients’ advertising budget will…

Digital channels continue to lead media investment growth

Correlating with the increasing importance and opportunities around brand advertising, we will see video channels such as programmatic video and connected TV (CTV) grow significantly.

Search and social remain important channels for brands and agencies with their easy-to-use self-service tools. With so many channels to choose from, advertisers building their omnichannel strategies must prioritise delivering a seamless digital experience across all channels.

Respondent Insights

How important is it to be able to advertise on the open internet (e.g., outside of Facebook, Google, Amazon, etc.)

of marketers say it is very important ( rated 7 out of 10 or higher)

of media agencies say it is very important ( rated 7 out of 10 or higher)