Data Insights 4 Key 2021 Tax Trends Understanding the tax consumer in the 2021 tax season

A Taxing Year

With people suddenly stuck at home and tax deadlines extended, the 2020 tax season was like no other. Although this tax season will return to its standard April 15 due date, employment and the way people operate their daily lives has changed dramatically — people are working from home, some filed for unemployment for the first time, and consumers were forced to test new technology and tools to do basic tasks from home.

We looked at industry changes and Quantcast consumer data to isolate major tax trends and shifts for the 2021 tax season.

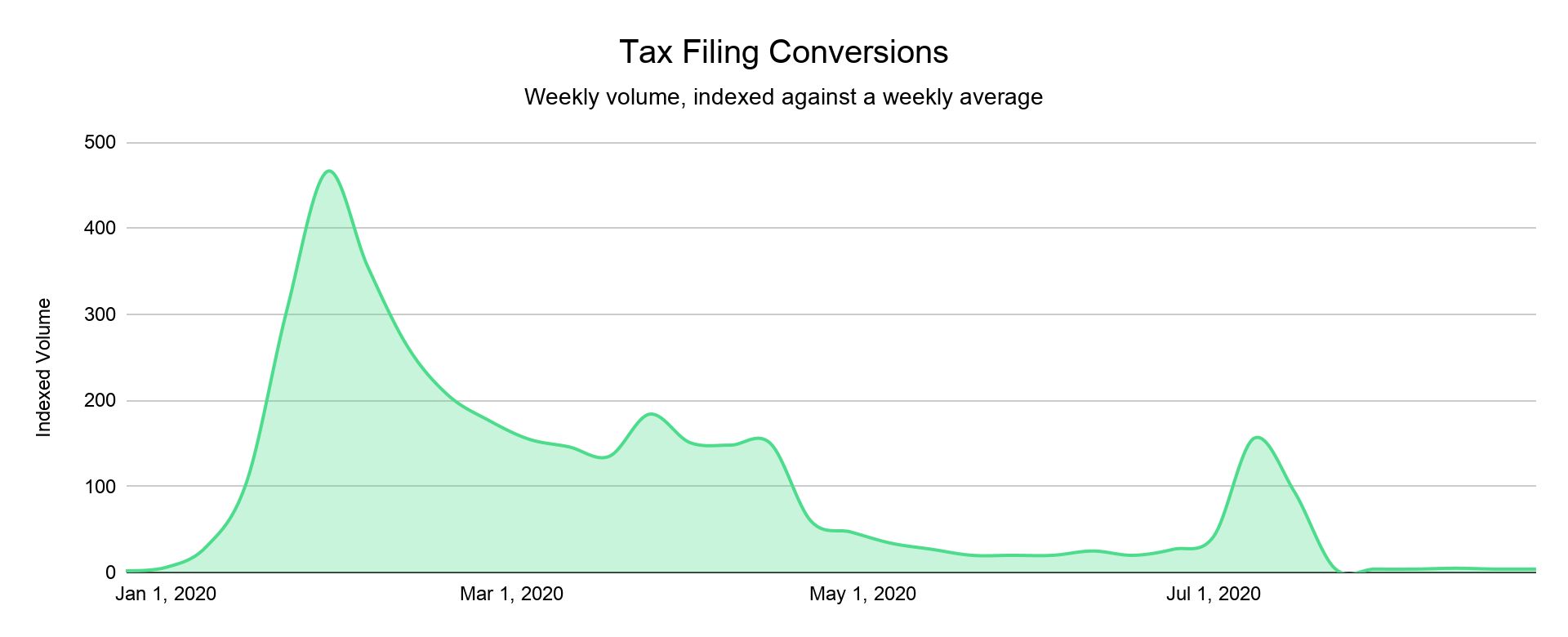

Tax Season stretches to six months

Acceleration of tax technology & tools

Tax preparation services have long invested in technology and tools, but the pandemic has accelerated its adoption across all sectors. Tax professionals and services who are early adopters will gain clear advantages over their competitors

These technologies and tools include :- SaaS and cloud software,

- plugged into real-time data

- Video conferencing and

- collaboration tools

- Automation technology to eliminate data entry

- Self-serve portals

- E-signature and E-filing options

How are consumers engaging

with these tax tools?

with these tax tools?

This technology shift must be carefully balanced with ways to drive greater engagement with consumers. Although newer resources such as virtual video calls drive huge efficiency gains and make tax professionals more accessible, it also weakens the consumer relationship that in-person meetings create.

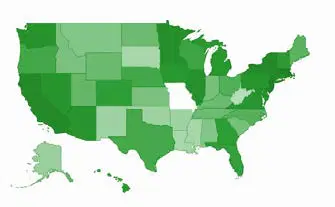

Looking at digital tax preparation services, Quantcast broke out consumers who file online with a tax software verses file with an online tax pro . Not surprisingly, those that spent more money by working with a tax professional were older and more established, but both groups were well educated and affluent, showing that tax services and tools are less leveraged by the average American.

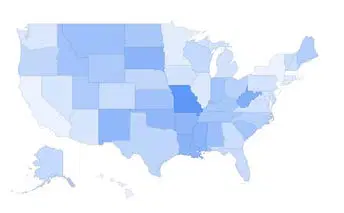

Where are your customers?

to ensure proper resource staffing and hours.

AI & machine learning become automation disruptors

Artificial intelligence has entered the tax marketplace, driven largely by big players such as Intuit, who see AI as a way to both create efficiency and help customers maximize their return. Historically, this has helped automate things such as sales tax calculations and address validation, but this technology is improving quickly and is now beginning to provide custom recommendations based on the most recent tax code, flagging potential errors, and using categorization software to provide small businesses with streamlined expense logs

AL & Machine Learning Tax Advantages

Consumers will need help navigating tax implications of recovery dollars

The pandemic resulted in an unprecedented number of individuals and businesses applying for unemployment and recovery programs, each with unique tax implications. For those filing for unemployment for the first time, they may be surprised to realize unemployment is taxable income and they owe a lot of money on their 2021 tax return.

The Paycheck Protection Program introduced under the CARES Act, allowed many businesses to take out large loans. If they qualified for loan forgiveness, IRS Notice 2020-32 denies borrowers the ability to deduct the same experiences that qualified them for the loan forgiveness, which may be a surprise to some small businesses who aren’t anticipating a higher tax bill.

The Great Divide:

Opportunity to focus on tax advisory & consulting

While technology, tools and AI provide consumers with easy ways to use machines to their advantage, this also changes the way we engage on a human level. In a decade deemed the “rise of the gig economy”, it has never been more important to find personalized solutions. This represents a market opportunity for tax services to rethink their business model, expanding to higher-margin advisory and consulting services. By letting the machines do what they are good at, we can have tax professionals go back to doing what they are good at — providing individuals with their expertise to help people get the most out of their returns.

For these client engagements, who files when?

4 Tax Takeaways Know & action on your audience

- Acceleration of tax technology & tools

- AI & machine learning become automation disruptors

- Consumers will need help navigating tax implications of recovery dollars

- Opportunity to focus on tax advisory & consulting