Creating Impossible Growth

Quantcast’s high performance advertising platform pushes beyond what’s humanly possible to optimize for better outcomes.

Trusted by

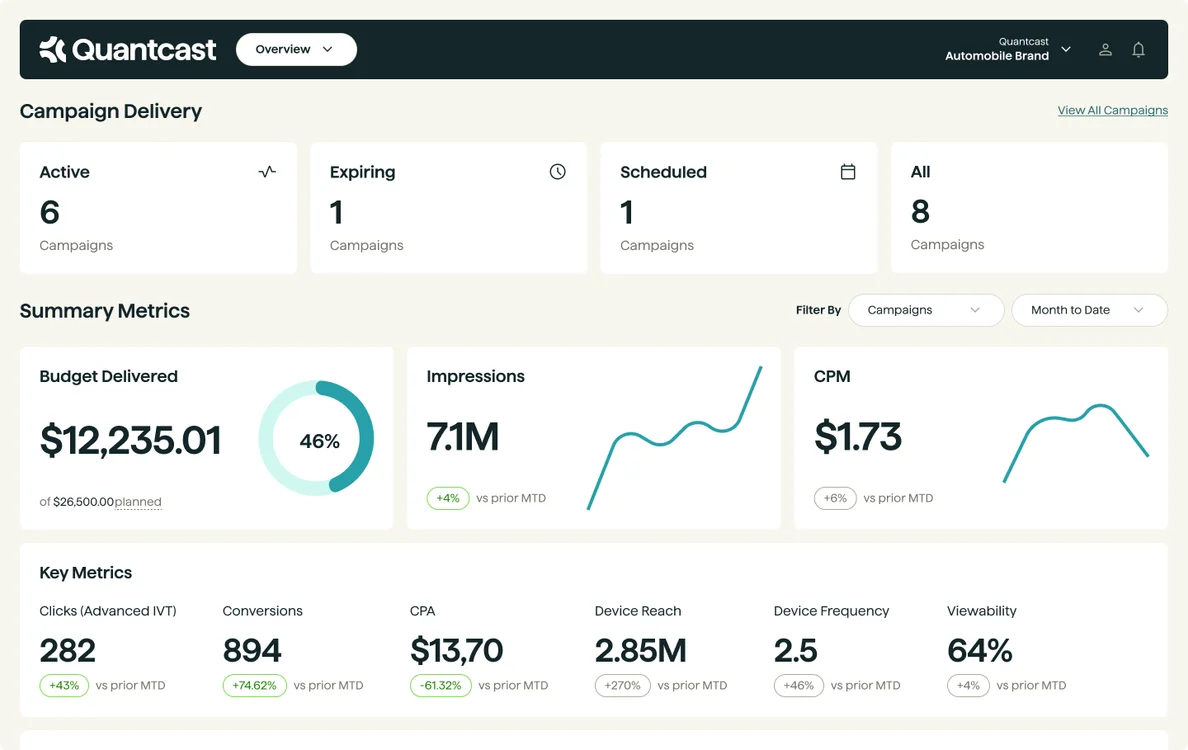

Built to outperform

Powered by AI, our omnichannel Demand Side Platform (DSP) works tirelessly to present you with the most complete, usable picture of real-time audience patterns. By rapidly interpreting the value of this data, it unlocks your advertising's full potential and frees you of all complexity. Giving you the space to think bigger.

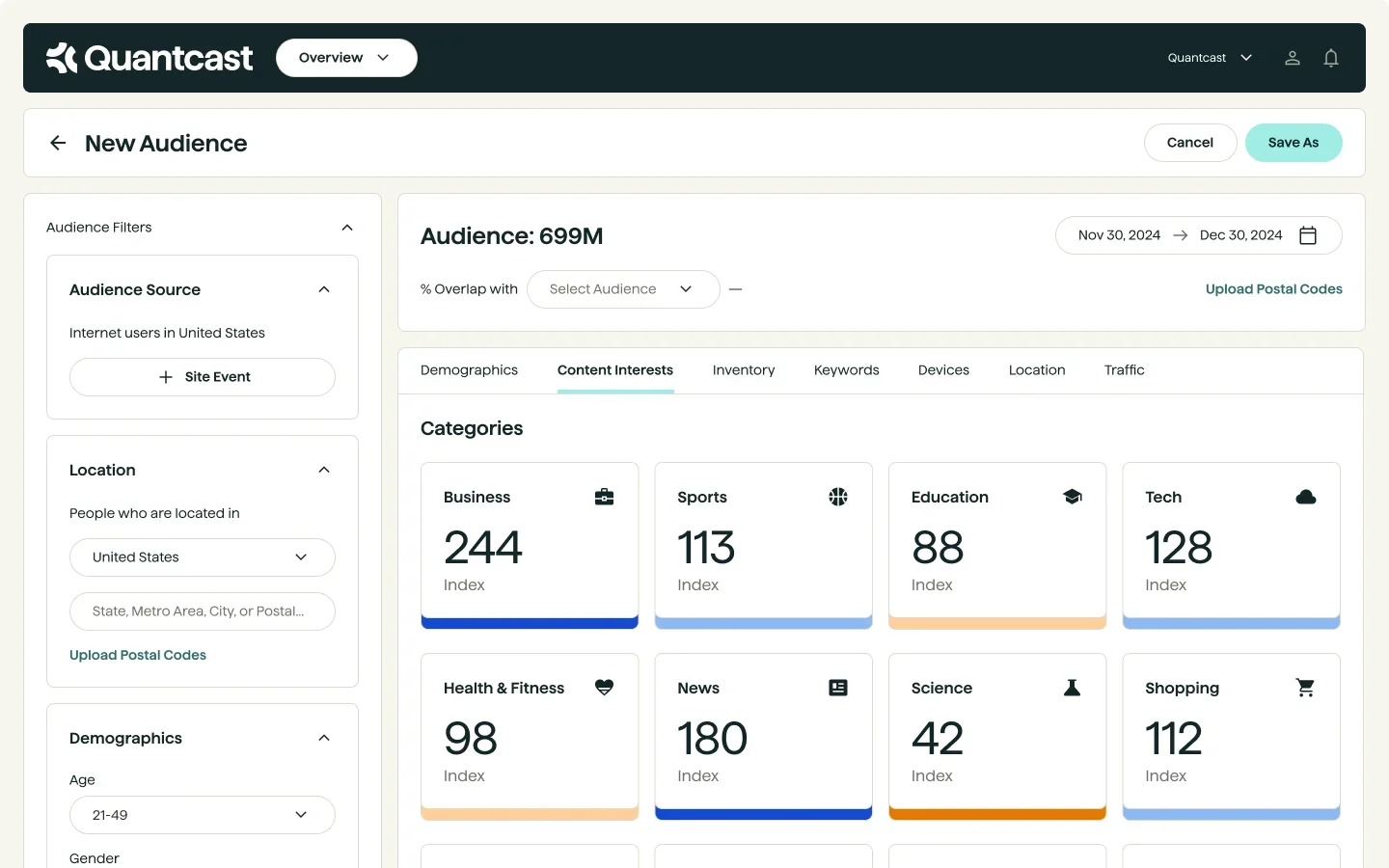

Your audience is your most powerful advantage

Our entire platform is founded on absorbing insight from audience behavior. The more we soak up, the more we can predict patterns, analyze metrics, and effectively control the outcomes of advertising — honing your confidence across every campaign.

“Quantcast delivers a strategic edge and preparedness for the future amid changes in the digital marketing space.”

in customer conversions vs. traditional DSPs

faster than traditional DSPs

Never waste your shot

The internet opened up everyone's world. Who are we to reduce that opportunity? Our engine works to maximize the impact and effectiveness of advertising, inspiring you to shape the future of your industry and dream up campaigns people actually care about.

Turn intelligence into performance